This article focuses on the Automobile Industry in India. India is the fourth largest automobile market with sales rising to 3.99 million units with an average growth rate of 8.3% yearly. India is the seventh biggest commercial vehicle producer.

The segment of Two Wheelers dominates the market in volume, due to the growing middle class and a young population. In addition, the company’s increasing interest in developing rural markets further aided the sector’s growth.

India is also a prominent automobile exporter, with high hopes for export development in the near future. During FY19, automotive exports grew 14.50 percent. It is projected to rise during 2016-2026 at a CAGR of 3.05 percent. However, multiple initiatives by India’s government and the major players in the automobile sector in India are projected to make India a global leader in the two-wheeler and four-wheeler industry by the end of the year 2020.

Key Facts of the Automobile Industry in India

- India is the world’s largest tractor manufacturer and second-largest bus maker.

- India is the world’s largest two-wheeler, three-wheeler maker.

- India is the world’s third-largest truck producer

- India is the fourth-largest manufacturer of cars.

- By 2026, India is projected to be the third-largest automotive market in the world in volume terms.

- Automobile Industry contributes 7.1 percent of India’s GDP.

- 35 million jobs are created in India by the automotive industry.

- India has a 40 percent stake in global automobile research and development.

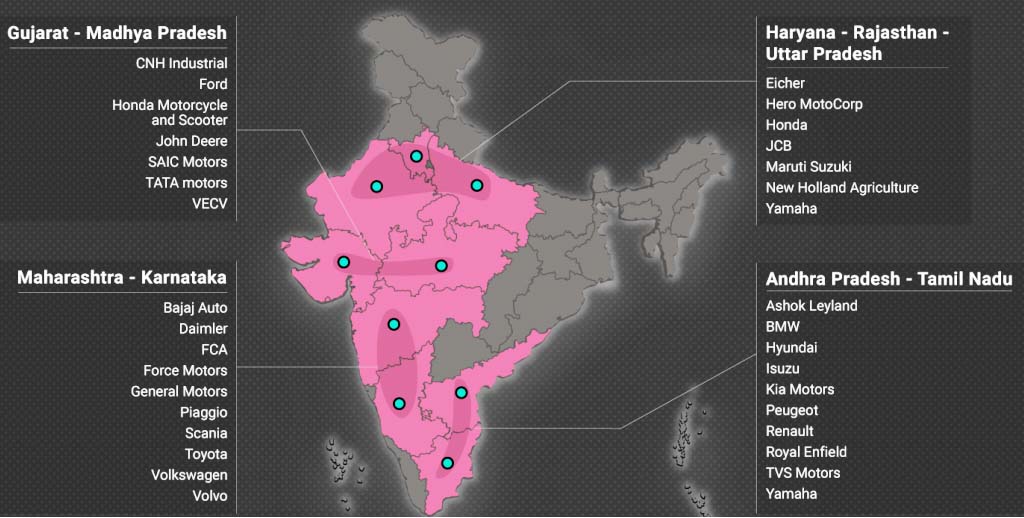

Manufacturing Clusters of Automobile Industry in India

Market Size of the Automobile Industry in India

- Total domestic car sales grew to CAGR 6.71 percent between FY13-19 with 26.27 million vehicles being sold in FY19. With 30.92 million vehicles produced in the country in FY19, domestic automotive production increased at 6.96 percent CAGR between FY13-19.

- Yearly growth in domestic sales across all categories was reported at 17.55 percent in commercial vehicles, followed by 10.27 percent growth in three-wheeler sales.

- Premium motorbike sales in India were over one million units. BMW has reported an 11 percent growth of sales in India BMW has sold 7,915 car units. Mercedes Benz was ranked first in sales satisfaction in the J D Power group of luxury cars.

- Sales of electric two-wheelers are projected to have exceeded 105,000 units in 2020-2022

Exports of the Automobile Industry in India

India’s automobile exports have gradually increased, with the United Kingdom becoming India’s main export market, followed by Italy, Germany, the Netherlands, and South Africa.

According to The New York Times, India’s large technical base and experience in the manufacture of low-cost, fuel-efficient cars has resulted in the extension of manufacturing facilities to many automobile companies such as Hyundai, Nissan, Toyota, Volkswagen, and Maruti Suzuki.

India has been a leading hub in the manufacture of small cars in recent years. Hyundai, the country’s main exporter, ships more than 250,000 cars annually from India. Besides the shipments of Maruti Exports to Suzuki’s other markets, Maruti Suzuki also produces small cars for Nissan, which sells them in Europe. Nissan will also be manufacturing small cars from its latest Indian assembly line. Tata Motors is selling its commercial vehicles to the Asian and African markets and is planning to sell hybrid cars in Europe. Bajaj Auto is developing a low-cost car for Renault Nissan Automotive India to sell the vehicle worldwide. Renault Nissan could also follow Ashok Leyland, a domestic producer of commercial vehicles, in another small car project. Although the potential for the Indian automotive industry is amazing, there are obstacles that may stand in the way of future development. As the demand for cars in recent years is closely related to global economic development and increasing personal incomes, manufacturing growth would decline if the economy is weakened.

Top 10 export destinations for Automobile Industry in India

| S.No. | Country | Value (US$) | Share% |

| 1 | United States | 1.2 billion | 8.4 |

| 2 | Mexico | $1 billion | 6.9 |

| 3 | South Africa | $888.8 million | 6.1 |

| 4 | United Kingdom | $637.4 million | 4.4 |

| 5 | Sri Lanka | $596.9 million | 4.1 |

| 6 | Bangladesh | $592.1 million | 4.1 |

| 7 | Turkey | $580.4 million | 4 |

| 8 | Nigeria | $546.8 million | 3.8 |

| 9 | United Arab Emirates | $433.6 million | 3 |

| 10 | Colombia | $428.9 million | 3 |

Production of the Automobile Industry in India

In April-March 2019, the industry produced a total of 30.915.420 vehicles including passenger cars, commercial vehicles, three-wheelers, two-wheelers, and a quadricycle compared to 29.094.447 in April-March 2018, showing a 6.26 percent raise over the same period last year.

Domestic Sales

- Passenger Vehicle sales grew by 2.70 percent over the same period last year in April-March 2019. Within commercial cars, Passenger Cars, Utility Vehicle & Vans sales increased by 2.05 percent, 2.08 percent, and 13.10 percent respectively during the same period in April-March 2019.

- In April-March 2019, the total segment of commercial vehicles recorded a rise of 17.55 percent. Medium & Heavy Commercial Vehicles (M&HCVs) rose by 14.66 percent and Light Commercial Vehicles in April-March 2019 expanded by 19.46 percent.

- In April-March 2019, sales of three Wheelers rose by 10.27 percent over the same period in the year 2018. Passenger Carrier sales went up 10.62 percent within the Three Wheelers and Goods Carrier rose 8.75 percent in April-March 2019 over April-March 2018.

- In April-March 2019, two Wheelers sales reported growth of 4.86 percent over April-March 2018. Scooters decreased by 0.27 percent within the Two Wheelers category, while Motorcycles and Mopeds increased by 7.76 percent and 2.41 percent in April-March 2019 over April-March 2018, respectively.

Sales of Domestic Automobiles in India from FY 2011 to FY 2019 in Million Units

| 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

| Two Wheeler | 11.8 | 13.4 | 13.8 | 14.8 | 16 | 16.5 | 17.6 | 20.2 | 21.18 |

| Passenger Vehicles | 2.5 | 2.6 | 2.7 | 2.5 | 2.6 | 2.8 | 3 | 3.3 | 3.4 |

| Commercial Vehicles | 0.68 | 0.81 | 0.799 | 0.63 | 0.61 | 0.69 | 0.71 | 0.86 | 1 |

| Three Wheelers | 0.53 | 0.51 | 0.54 | 0.48 | 0.53 | 0.54 | 0.51 | 0.64 | 0.7 |

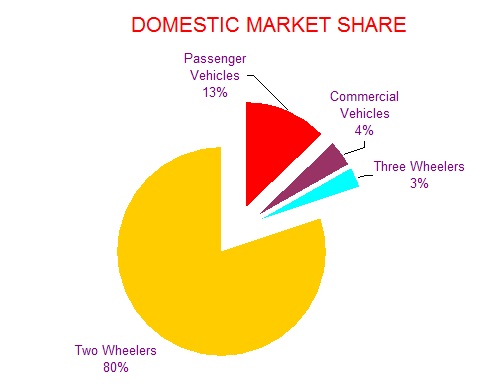

Domestic Market Share in Automobile Industry in India for 2018-2019

| Passenger Vehicles | 13 |

| Commercial Vehicles | 4 |

| Three Wheelers | 3 |

| Two Wheelers | 80 |

| Grand Total | 100 |

Total Sales of Cars in the year 2018 and 2019

| S.No. | Company | 2019 sales | 2018 sales |

| 1 | Maruti Suzuki | 1,485,943 | 1731179 |

| 2 | Hyundai | 510,260 | 550002 |

| 3 | Mahindra | 219,663 | 232181 |

| 4 | Tata Motors | 152,944 | 213625 |

| 5 | Honda | 134,741 | 174880 |

| 6 | Toyota | 126,701 | 151480 |

| 7 | Renault | 88,869 | 82368 |

| 8 | Ford | 73,636 | 97804 |

| 9 | Kia | 45,494 | 0 |

| 10 | Volkswagen | 32,324 | 37029 |

| 11 | Nissan-Datsun | 23,580 | 41583 |

| 12 | MG Motor | 15,930 | 0 |

| 13 | Škoda | 15,284 | 16692 |

| 14 | Fiat Chrysler | 11,238 | 19030 |

Exports

Overall automobile exports increased by 14.50 percent in April-March 2019. Although exports of passenger vehicles decreased by 9.64 percent, in April-March 2019, Commercial Vehicles, Three Wheelers, and Two Wheelers reported growth of 3.17 percent, 49.00 percent, and 16.55 percent respectively over the same period in the year 2018.

Investments in Automobile Industry in India

Many car makers have started spending aggressively in different segments of the market to keep up with the increasing demand. According to data published by the Department for the Promotion of Industry and Internal Trade (DPIIT), the sector has drawn Foreign Direct Investment (FDI) worth US$ 22.35 billion over the period April 2000 to June 2019.

Some of the recent/planned investments and developments in the automobile sector in India are as follows:

- Audi India is planning to introduce nine all-new models including Sedans and SUVs along with revolutionary electric vehicles (EVs).

- Premium motorbike sales in India recorded a seven-fold jump in domestic sales reaching.

- Toyota aims to spend US$ 100 million for self-driving and robotic technology start-ups.

- Ashok Leyland has announced a capital outlay of Rs 1,000 crore (US$ 155.20 million) to launch 20-25 new models across various types of commercial vehicles.

- Hyundai plans to invest 1 billion US dollars in India. SAIC Motor has announced that it would invest 310 million US dollars in India.

- Mercedes Benz has expanded its Chakan plant’s production capacity to 20,000 units a year, the largest for any luxury car fabrication in India.

- Mahindra Electric Mobility has opened its manufacturing hub for electrical technologies in Bangalore with an investment of Rs 100 crore (US$ 14.25 million) that will raise its annual production capacity to 25,000 units.

Government Initiatives for Automobile Industry in India

India’s government is encouraging foreign investment in the automotive industry and allowing 100 percent FDI under the automatic route.

Some of the Government of India’s latest initiatives are :

- Under the Union Budget 2019-20, the government declared that it will include an extra Rs 1.5 lakh (US$ 2.146) income tax deduction on interest charged on loans taken to buy EVs.

- The Government is planning to grow India as a global manufacturing center and a center for R&D.

- Under NATRiP, India’s government aims to build R&D centers at a total cost of US$ 388.5 million to allow the industry to meet global standards.

- In the context of the FAME (Faster Adoption and Manufacturing of (Hybrid) and Electric Vehicles in India) program, the Ministry of Heavy Industries, Government of India has shortlisted 11 cities in the country for the implementation of electric vehicles (EVs) in their public transit networks. The State will also create an incubation center for start-ups operating in the area of electric vehicles.

- The Indian government approved the FAME-II program in February 2019, with a fund allocation of Rs 10,000 crore (US$ 1.39 billion) for FY20-22.

Achievements

Following are the achievements of the government in the past four years:

- Inter-ministerial approved 5,645 electric buses for 65 towns on 29 July 2019.

- NATRIP’s application for a NATRIP Implementation Society Quality Certificate Grant-In-Aid for Test Facility Systems for Electric Vehicles (EV) under the FAME Scheme approved by the Project Implementation and Sanction Committee (PISC) on 3 January 2019.

- The number of funded vehicles under the FAME program rose from 5,197 in June 2015 to 192,451 in March 2018. FAME Scheme funded 47,912 two-wheelers, 2,202 three-wheelers, 185 four-wheelers, and 10 light commercial vehicles during 2017-18.

- After 2015, the National Automotive Testing and R&D Infrastructure Project (NATRIP) have developed testing and research centers in the country. Including National Institute for Automotive Inspection, Maintenance & Training (NIAIMT), Silchar, Global Automotive Research Centre (GARC), Chennai, National Automotive Testing Tracks (NATRAX), Indore, Automotive Research Association of India (ARAI), Pune

- SAMARTH Udyog – Industry 4.0 centers: Prototype cum experience centers are being set up throughout the country to encourage smart and innovative manufacturing to support small and medium-sized businesses adopt Industry 4.0 (automation and data sharing throughout production technology).

Road Ahead

The automobile industry is supported by various factors such as availability of skilled labor at low cost, robust R&D centers and low-cost steel production. The industry also provides great opportunities for investment and direct and indirect employment to skilled and unskilled labor.

The Indian automobile industry (including the manufacture of components) is projected to cross Rs 16.16-18.18 trillion by 2026 (US$ 251.4-282.8 billion).